Explainer: What if US economy goes into recession? How it may impact India

如果美国经济陷入衰退怎么办?将如何影响印度?

NEW DELHI: The US Federal Reserve is expected to lift interest rates by three-quarters of a percentage point for a third straight time on Wednesday and signal how much further and how fast borrowing costs may need to rise to tame a potentially corrosive outbreak of inflation.

新德里:周三,美联储有望连续第三次加息0.75个百分点,并预示了借贷成本可能需要上升多少、多快,才能遏制潜在的破坏性通胀爆发。

While investors largely expect the Fed to lift its policy rate by 75 basis points to the 3.00%-3.25% range, markets could be unsettled by the updated quarterly economic projections that will be released along with the policy statement.

The Wall Street is worried that the rate hikes could go too far in slowing economic growth and push the economy into a recession. Those concerns have been heightened by data showing that the US economy is already slowing and by companies warning about the impact of inflation and supply chain problems to their operations.

尽管投资者普遍预计到美联储将把政策利率上调75个基点,至3.00%-3.25%的区间,但与利率政策声明同时发布的最新季度经济预测仍然可能会令市场感到不安。

华尔街担心,上调利率可能会导致经济增长放缓,导致经济陷入衰退。数据显示,美国经济正在放缓脚步,企业警告称,通胀和供应链问题将对业务产生影响,这些都加剧了上述担忧。

Apart from the US, economic contraction was witnessed in Britain as well. Even the Eurozone is still not out of the pandemic woods, and China has just stalled in its track in Q1, weighed down by successive lockdowns of its large cities.

Both US and China are currently battling a slowdown. In such a scenario, it won't be wrong to say that when two of the biggest economies in the world are facing such economic downturn, fears of recession are more than valid. And, if that happens, spillover effects are sure to affect India as well.

除了美国,英国也出现了经济萎缩。欧元区也尚未走出疫情的阴影,而中国在第一季度受到大城市连续隔离封控的拖累也停滞不前。

美国和中国目前都在与经济放缓作斗争。在这种情况下,在世界上最大的两个经济体都在面对经济低迷的阴霾时,可以说人们对经济衰退的担忧是完全有道理的。如果真的发生经济衰退,溢出效应肯定也会影响到印度。

Where does India stand

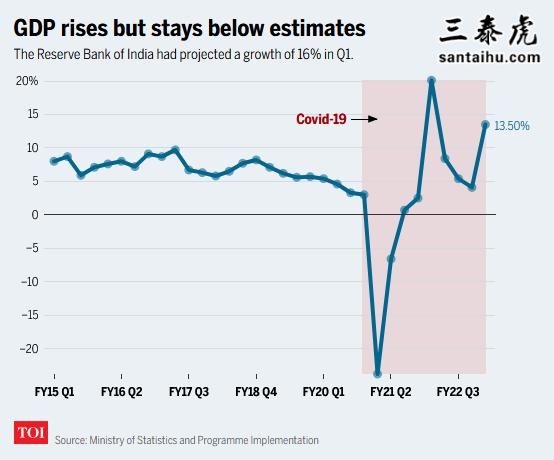

In the first quarter ended June 30, 2022, India reported a 13.5% jump in its gross domestic product (GDP). Even though the numbers seem to be good enough on the face of it, but it is 2.7 percentage points lower than what Reserve Bank of India (RBI) projected.

印度的情况如何?

截至2022年6月30日的第一季度,印度国内生产总值(GDP)增长了13.5%。尽管从表面上看,这个数字非常优秀,但它比印度储备银行(RBI)的预测低了2.7个百分点。

Hence, the GDP numbers turned out to be a disappointment for many. There was expectation of a bigger bounce back from the first quarter of last year when economic activity was crippled by the delta wave of Covid-19.

If we see, the numbers show fastest growth in a year. Last time India's GDP had shown a massive jump was in Q1 of FY22 when it recorded a surge of 20.1%. However, there has in fact been a slowdown in pace of growth momentum, which points to GDP decelerating further in the quarters to come.

因此,这个GDP数据让很多人感到失望。由于新冠肺炎,去年第一季度的经济活动受到重创,当时人们预期经济会出现更大的反弹。

如果我们看一下数据会发现,数据显示这是一年来最快的增长。印度GDP上一次出现大幅增长是在22财年第一季度,增幅达20.1%。事实显示,印度的经济增长势头已经放缓,这预示着GDP在未来几个季度将进一步减速。

GDP growth may slow.

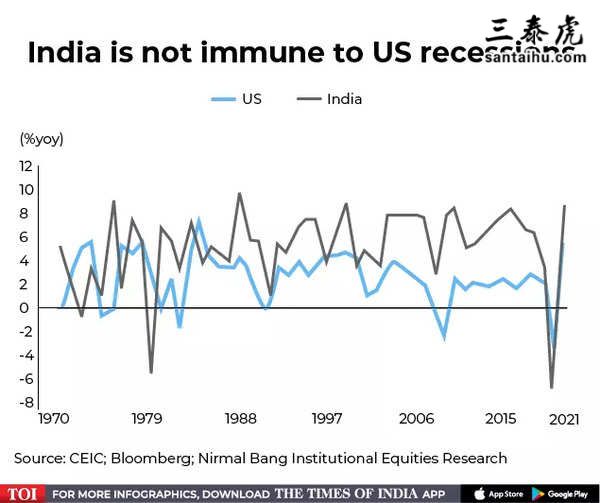

A report by Nirmal Bang securities suggests that India is not immune to a US recession and domestic growth has slowed by approxmately 1.5-2.5% even in normal Fed-led recessions.

GDP增长可能放缓

Nirmal Bang证券公司的一份报告显示,印度无法避开美国经济衰退的影响,印度国内经济增长放缓了约1.5-2.5%。

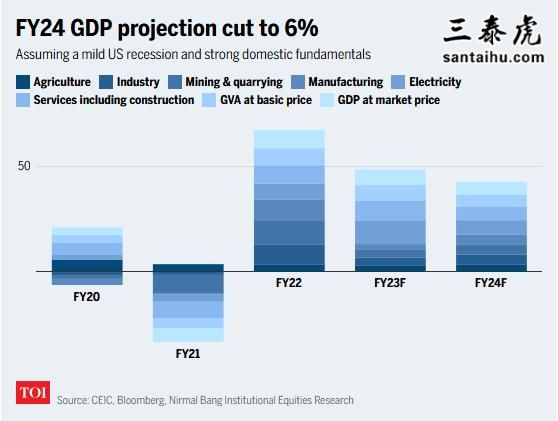

"Assuming a mild US recession and GDP growth of 7.5% in FY23 in our base case, we believe that GDP growth could slow to 6% in FY24 (revised down from 7% earlier)," the report added.

Citing examples from previous data, it pointed out that even a shallow, short-lived recession in the US has the potential to bring down GDP.

报告补充说:“假设美国经济小幅度衰退,我们23财年GDP增长7.5%,我们认为24财年GDP增长可能放缓至6%(从之前的7%向下修正)。”

报告引用了以往数据中的一些例子,指出即使是美国发生的轻微、短暂的衰退也有可能导致印度GDP的下降。

However, it goes on to project that relatively stable domestic fundamentals in terms of strong financial sector and non- financial sector balance sheets, high foreign exchange reserve and some amount of countercyclical fiscal policy ahead of elections in FY24 will limit the growth slowdown to 1.5%.

The report further slashed economic growth estimate for FY24 from 7% to 6%, assuming that the US suffers a mild recession.

"In a worst case scenario, growth could slow to 5% or below," it added.

然而,报告继续预测,相对稳定的国内经济基本面——势头强劲的金融部门和非金融部门资产负债表、高额外汇储备和24财年选举前的一些反周期财政政策——将把增长放缓程度限制在1.5%。

该报告进一步将24财年的经济增长预期从7%下调至6%,假设美国遭遇温和衰退。

“在最坏的情况下,增长可能放缓至5%或更低,”报告补充到。

What will be the probable impact

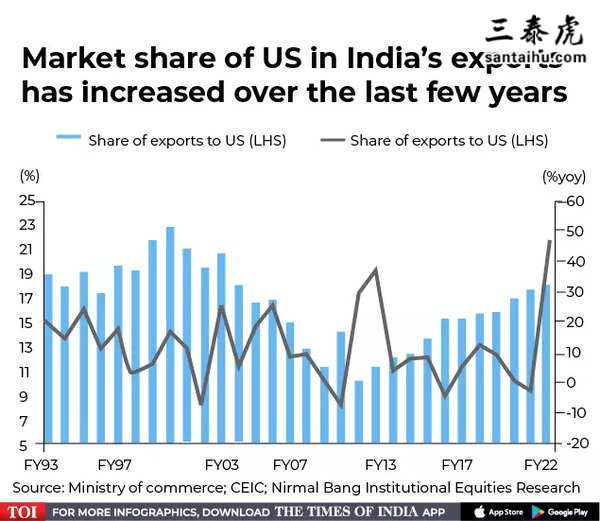

* Merchandise exports may fall: With US being one of India's major trading partners, its market share in India's merchandise exports stood at 18.1% in FY22.

As a result, India is vulnerable to a US recession, the Nirmal Bang report said. Software exports are expected to be worst hit in India.

可能带来的影响有哪些?

*商品出口可能下降:由于美国是印度的主要贸易伙伴之一,22财年美国在印度商品出口中的市场份额为18.1%。

因此,印度很容易受到美国经济衰退的影响。预计印度的软件出口受到的打击将最为严重。

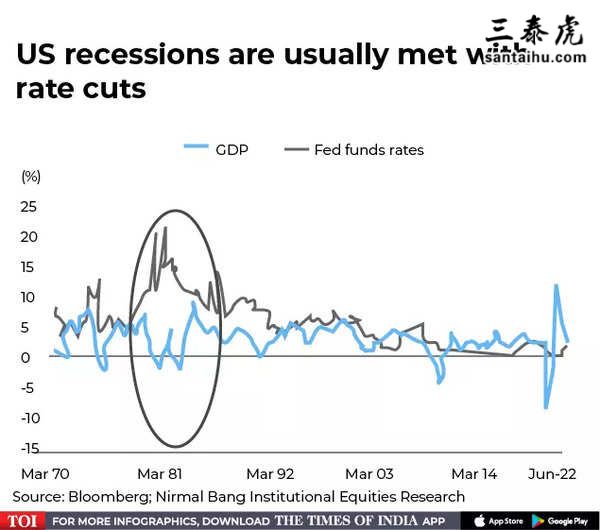

* Interest rate trajectory: Historical data cited by the Nirmal Bang report showed that past periods of recession or significant slowdown in growth in the US have been usually countered by rate cuts from the Federal Reserve. Contrary to this, the Fed has been on a rate hike spree since March 2022 in a bid to tame inflation that has jumped to 40-year high in the world's biggest economy.

*利率轨迹:Nirmal Bang报告引用的历史数据显示,历史上美国经济出现衰退或增长大幅放缓,通常都会被美联储的降息所抵消。与此相反,自2022年3月以来,美联储一直在大举加息,以抑制这个全球最大经济体飙升至40年高点的通胀。

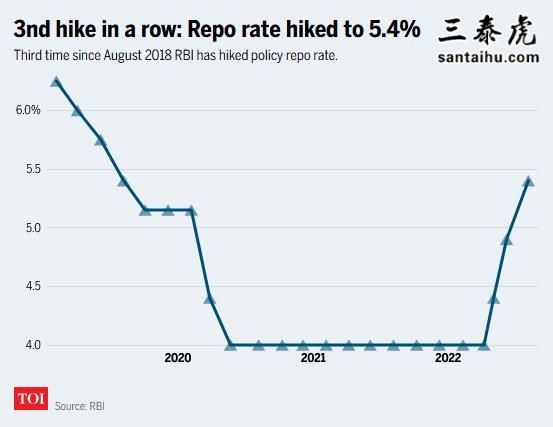

Experts believe that continuous rate hikes by central banks have contributed a great deal to the slowdown in growth. Like India, central banks all over the world faced twin challenges of whether to opt for growth or curb inflation, and majority of them went for the latter.

专家们认为,各国央行的持续加息在很大程度上导致了经济增长放缓。与印度一样,世界各地的央行都面临着双重挑战:是选择增长还是遏制通胀,而大多数央行都选择了后者。

RBI & the Fed

The report further noted that India's rate hike cycle has never moved in the opposite direction to that of the Fed. However, there have been periods of extended pauses in the 1970s and 1980s when the Fed had raised as well as cut rates.

印度央行和美联储

该报告进一步指出,印度的加息周期与美联储的加息周期完全吻合。不过,上世纪70年代和80年代,美联储既加息又降息,期间印度也采取过长时间的观望。

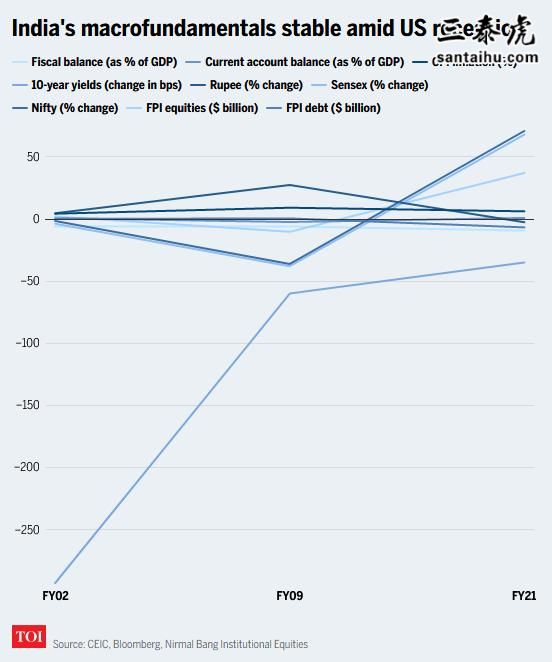

India during past US recessions

The chart below shows how India performed amidst past few phases of US recession. India's fiscal deficit has remained high on counter-cyclical policy support while inflation may be relatively contained. At present India's inflation level is at 6.2%, much lower than 9.1% in FY09.

历史上美国经济衰退期间的印度

下图显示了印度在历史上美国几次经济衰退中的表现。在反周期政策的支持下,印度的财政赤字一直处于高位,而通胀可能得到相对控制。目前印度的通货膨胀水平为6.2%,远低于09财年的9.1%。

以下是印度时报读者的评论:

Guest

India's domestic market continues to grow in its ability to spend. This will cushion the impact of recession on India led by the developed nations. Its high end exports and IT will be hit due to drop in their demand. All in all a far less painful year ahead for India.

印度国内市场的消费能力持续增长。这可以缓冲以发达国家为首的经济衰退给印度带来的负面影响。

由于国际需求下降,中国的高端出口和信息技术(IT业)将受到冲击。总而言之,对印度来说,未来的一年日子不会难过。

Prasen Kumar•Hyderabad

What is the point in growth, when there is high inflation, how it will help economy. Recession in US is certainly going to impact India and other countries as well.

如果通货膨胀率升高,经济增长又有什么意义,对经济有什么帮助?美国的经济衰退肯定会影响到印度和其他国家。

TruthSeeker

The moment world drops US as a reserve currency esp when it comes to buying oil, US dollar will collapse like a deck of cards. Unfortunately Saudis has a veto power amongst the OPEC countries so, they will never let this happen in exchange of the protection by the US army.

只要世界各国摒弃美元作为储备货币,特别是在购买石油的时候,美元就会纸牌屋一样应声崩塌。不幸的是,沙特在欧佩克国家中拥有否决权,所以他们绝不会让这种情况发生,他们还需要美国军队的保护。

Vijay Desikan• TruthSeeker•USA

For your information, the U.S. had its maxmum growth in late 1800s and early 1900s when the dollar was NOT the reserve currency. The U.S. not only did not collapse like a deck of cards but it was booming without the burden on being a reserve currency.

美国在19世纪末和20世纪初的经济增长速度最快,当时美元还不是储备货币。美国不仅没有像纸牌屋一样崩塌,还因为无需背负储备货币的负荷而蓬勃发展。

•16 days ago

Boost trunk infrastructure building and Build digital voting our economy will boom.

加强基础设施建设,打造电子投票系统,我们的经济必将蓬勃发展。

Mohan•California, USA

This article was not written by an economist. I don't see any name near the title. Most likely it is written by a journalist based on whatever he/she heard from others to sensitize the news.

这篇文章不是经济学家写的,文章标题下面没有署名,极有可能是某个记者根据道听途说的东西加工成一篇敏感新闻。

Pervinder Sangwan

2 days back, same newspaper was saying..India Economy is resilient..strong enough and there won't be any effect of other countries weak economy..,Keep writing anything and we have no option..other then keep reading your useless articles.

两天前,就是这家报社还报道过,印度经济很有弹性,很强大,不会受到其他国家经济疲软的影响。随便吧,你们爱写啥就写啥,反正我们除了继续看你们废话也没得选择。

User Carmo Costa-Viegas•16 days ago

Are we racist ? Why only look at America and Europe ? In the same manner they look at our large population for profits , why can't we turn out attention to Africa and Asia ?

我们是种族主义者吗?为什么只盯着美国和欧洲不放?他们也盯着我们庞大的人口,一心想从我们身上赚钱,我们为什么不关注以下非洲和亚洲?

•16 days ago

it shouldn't affect india at all, start dealing in ₹ with every body. let our economy be independent of $

这对印度没有丝毫影响,开始用卢比跟全世界做生意吧。让我们的经济跟美元脱钩吧。

Mohan• Guest•California, USA

So your understanding of the economy is based only on Rs and $? The problems will solve if every transaction is done in Rs?

所以你觉得经济就是简单的卢比和美元?改用卢比来结算,问题就迎刃而解了?

User Mohanty•16 days ago

Probably, the scenario will be worse than 2008.As,in 2008 RBI had enough tool for quantitative ease for the economy to breathe. But now,it would be too difficult for easing the rates or loose the purse for the economy to flourish on easy money.There will be typical situation this time and the ground reality is beyond imagination to calculate as of now.

情况可能会比2008年更糟。2008年的时候,印度央行有足够的量化宽松工具让经济喘口气。但现在,要想通过放松利率或放松银根来实现经济繁荣都太难了。这次可能会出现极端情况,目前根本无法想象。

User Singh

Q) What are the 3 ingredients for a perfect storm.,Ans) 1. Taking the dollar off gold standard,2. Making it the reserve currency of the entire planet,3. Start printing unlimited dollars at home, We must all thank US for transferring their collective debt to the rest of the world

问:完美风暴的三种组成成分是什么?

答:1、美元脱离金本位。

2、让美元成为整个星球的储备货币。

3、美国开始无限印刷美元。我们都必须感谢美国把美国债务转移到世界其他地方。

•16 days ago

It is counter-intuitive but RBI should cut rates and boost growth.

这有违直觉,但印度央行应该降低利率,促进增长。

•16 days ago

We are immune for a long term by domestic demands. There would be short term pain though and consumption would decrease to adjust to the slowing economic activity, however it will spring back up in no time. Jai Hind !

国内需求对我们基本没有影响。短期内会经历阵痛,人们减少消费来适应经济活动的放缓,但随后消费就会很快回升。

•16 days ago

If US economy goes into recession and India continues to grow FAST, USD will appreciate to 200 INR soon.

如果美国经济陷入衰退,而印度经济继续快速增长,美元很快就会升值到200卢比。

•16 days ago

Under the name of saving Ukraine, both Bidenbhai and Zellubhai are destroying each other's countries. We should keep clear of the USA trap.

打着拯救乌克兰的旗号,拜登和泽连斯基打得你死我活。我们应该远离美国的陷阱。

Trouble Shooter•Akhanda Bharat

Dollar will no longer be favoured mode of currency and it is likely to be replaced by the rouble or rupee.

美元不再是最受欢迎的货币,很可能被卢布或卢比所取代。

Ravindra Munvar•Bangalore

This time, it will not impact India much. India has a lot to spend on itself.

这次对印度的影响有限。印度可以靠自己。

Pipe•Bharat•16 days ago

Of course, many will now blame the US recession on PM Modi. It is amazing how powerful PM Modi is, that he controls multiple economies - not just India.

当然,许多人现在会把美国经济的衰退归咎于莫迪总理。莫迪总理这么有能耐啊,不单印度,他还一手控制着多个经济体呢,我真是孤陋寡闻了。

•16 days ago

useless sponsored article. Intention is to scare India.

一文不值的文章,就是为了恐吓印度。

Sanjay Sehgal• Uddat Uddalak•Noida

USA is going down the hill taking Europe and China with it. Good for India, and the reason why USA wants war with Russia with its puppet Zelenskky.

美国正率领着欧洲和中国一起走下坡路呢。这对印度是好事,这也是美国非要让俄罗斯和美国傀儡泽连斯基开战的原因。

prashant parekh

Before 10 years India's economy was elastic to what was happening in the world, now the economic indicators have reversed. If India suffers ..... the world will suffer.

10年前,印度经济会受全球局势的影响,但现在经济指标已经逆转。如果印度经济表现不佳.....全世界都会跟着遭殃。

Lester Pereira

So much of pie chart 13%7% increase gdp repo rate decline so much diagram no one knows what the news is about.. Can't we be advised in normal easy layman way what amd how it will affect normal public. Yeh itna percentage diagram no one can understand. Only the journalists may know. Rest humko samjha nhi. Z*zzzzz

贴那么多饼图,什么13%,7%的GDP增长率,什么回购利率下降,搞那么多图,但还是没人能搞懂新闻讲了什么。我们就不能通俗易懂地让普通大众明白,他们会受到什么影响吗?

Pipe• User Nath•Bharat

As long as India is out of the clutches of first family, we are better off no matter how bad the situation might seem.

只要印度脱离第一家庭的控制,我们就会过得更好。

Brahmajosyula Prasanna Kuma

Thinking that it will affect India a lot is being too frightened it will affect but if correct steps are taken here then we can teach them a lesson or two..

认为印度经济会因此受到严重影响是大惊小怪了,印度经济确实会受影响,但如果我们采取正确的措施,我们可以给他们点颜色瞧瞧。

此文由 三泰虎 编辑,未经允许不得转载!:首页 > 资讯 » 如果美国经济陷入衰退怎么办,将如何影响印度

德国媒体:批评人士对印度经济有什么误解

德国媒体:批评人士对印度经济有什么误解 德媒:特朗普和哈里斯,谁当选对美国经济更有利

德媒:特朗普和哈里斯,谁当选对美国经济更有利 印度经济有多强劲

印度经济有多强劲 印度股市崩盘:在美国经济衰退担忧的打击下,BSE Sensex和Nifty50暴跌

印度股市崩盘:在美国经济衰退担忧的打击下,BSE Sensex和Nifty50暴跌 中国削减从美国进口,美国经济能否维持下去吗

中国削减从美国进口,美国经济能否维持下去吗 印度经济案例研究,莫迪3.0,印度能超过德国吗

印度经济案例研究,莫迪3.0,印度能超过德国吗 在过去的6年中,莫迪是如何一步步摧毁印度经济的

在过去的6年中,莫迪是如何一步步摧毁印度经济的 2024年印度会出现经济衰退吗

2024年印度会出现经济衰退吗