Why Indian Rupee is falling down? India has biggest gold reserve in the world. What's wrong with the economy of India?

为什么印度卢比在贬值?印度拥有全球最大的黄金储备,印度经济怎么了?

以下是Quora网友的评论:

Mo-Anything

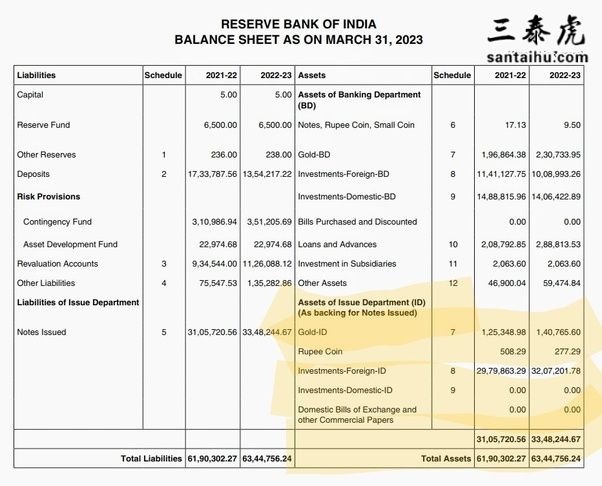

Gold holdings are in private hands and not on RBI’s balance sheet. The central bank holds around 600B in reserves comprising of gold and foreign exchange to finance imports.

Since the country does not generate export surpluses, reserves are composed of foreign fund flows from FDIs, FIIs, sovereign & commercial borrowings, NRI remittances, etc.

黄金都在私人手中,并没有在印度央行的资产负债表上。央行持有约6000亿美元的储备,包括黄金和外汇,为进口提供资金。

由于印度没有出口盈余,储备只能由外国直接投资、境外机构投资、主权和商业借款、境外侨胞汇款等外国资金流组成。

Nitin Kumar

There are a few key reasons why the Indian rupee is falling in value despite India having large gold reserves:

尽管印度拥有大量黄金储备,但印度卢比一直贬值,有几个主要原因:

Widening trade deficit - India imports far more than it exports, resulting in more demand for foreign currency like dollars to pay for imports. This strengthens the dollar relative to the rupee.

Foreign fund outflows - Foreign investors have been withdrawing money from India's capital markets due to global uncertainty, putting downward pressure on the rupee.

High inflation and interest rates - India's high inflation and RBI rate hikes to combat it have contributed to the rupee's decline. High rates can dampen economic growth.

不断扩大的贸易赤字—印度的进口远远超过出口,导致印度对美元等外币的需求增加。这使得美元相对于卢比走强。

外国资金外流—由于全球不确定性,外国投资者一直从印度资本市场撤出资金,给卢比带来了下行压力。

高通胀和利率—印度的通胀率较高、印度央行为了应对通胀采取加息,导致卢比下跌。高利率可能会抑制经济增长。

Surging oil prices - As an oil importing country, high global crude prices severely impact India's import bill and trade imbalance.

Geopolitical tensions - Global conflicts like the Russia-Ukraine war contribute to elevated oil prices and risk-off sentiment that weakens emerging market currencies like the rupee.

Strong US dollar - The flight to safety has strengthened the US dollar index considerably, weighing down currencies of develo countries.

油价飙升—作为石油进口国,全球原油价格居高不下,严重影响了印度的进口商品价格,造成贸易失衡。

地缘政治紧张局势—俄乌战争等全球冲突推高了油价和避险情绪,削弱了卢比等新兴市场货币。

强势美元—避险资金大幅推高了美元指数,压低了发展中国家的货币价值。

While India has sizable gold reserves, these have limited impact in influencing currency fluctuations in modern economies driven by complex factors like trade flows, capital movements, and differences in interest rates and inflation. The rupee's slide indicates India's current macroeconomic challenges outweighing the benefits of gold reserves.

Fundamental domestic reforms and progressive economic policies are needed to spur growth, attract investment, boost exports and restore stability to the Indian rupee over the long-term.

虽然印度拥有庞大的黄金储备,但在贸易流动、资本流动、利率差异和通胀等复杂因素驱动的现代经济体中,这些储备对影响货币波动的影响有限。卢比的下跌表明,印度目前的宏观经济问题超过了黄金储备的好处。

印度需要进行国内基本面的改革和循序渐进的经济政策来刺激经济增长,吸引投资,促进出口,恢复印度卢比的长期稳定。

Krishnan Unni Madathil

India doesn’t have the biggest gold reserve in the world. That title goes to the US. The US dollar has been rising due to rising interest rates which is pushing all other currencies including INR down. The USD competes with gold for influence; and rising price of USD means that funds from across the globe will make a beeline for the USD assets.

The only way for INR to strengthen is to make India and assets in India more fairly valued by the world so that people can trust the INR more as a store of value.

印度并不是世界上黄金储备最大的国家。这个第一属于美国。因为利率上升,美元一直在上涨,推低了包括印度卢比在内的所有其他货币。美元与黄金争夺影响力;美元价格的上涨意味着来自全球的资金将直接流向美元资产。

印度卢比走强的唯一途径是让印度和印度的资产在世界上得到更公平的估值,这样人们就会更相信印度卢比是一种价值储存手段。

Surendra Jamuar

Inflation is a common phenomena and all countries suffer from this.Every family has increased income and reduced value of currency.

通货膨胀是一个普遍现象,所有国家都受到通货膨胀的影响。每个家庭的收入都增加了,但货币贬值了。

Sandeepan Bose

Check out India's gold reserve below

看看下面印度的黄金储备

It isn't the largest gold reserve.

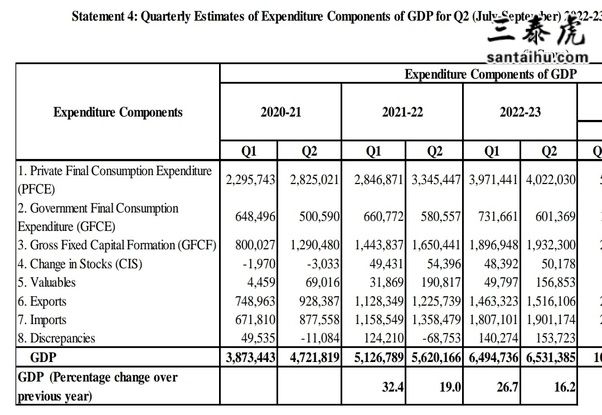

Now look at India’s important export numbers below

印度的黄金储备并不是最大的。

现在看看下面印度的重要出口数据

We have a huge negative balance of trade.

How can you expect the value of INR to be stable in FX markets. We have a long history of a negative balance of payments.

The economy of India has no connection with the value of INR in FX marketd.

The economy of a country is measured by its GDP.

Our GDP is growing. Growing better than developed countries.

印度的贸易逆差很大。

印度卢比的价值在外汇市场上要如何保持稳定呢?长期以来,我们的国际收支一直是负数。

印度经济与外汇市场的印度卢比价值没有联系。

一个国家的经济是用GDP来衡量的。

我们的GDP正在增长,甚至比发达国家的增长率更高。

The economy of any country depends on two things.

The productivity of the citizens of the country

The amount of money invested as capital in businesses in the country by entrepreneurs.

We have a poor productivity. 70% of India lives in the rural hinterland but contribute to just 17% of the GDP.

所有国家的经济都取决于两件事:

本国公民的生产力

企业家对本国企业的投资金额。

我们的生产力很低。70%的印度人生活在内陆农村地区,但只贡献了GDP的17%。

These 70% people don't care about formal education. They don't consume any manufactured goods. They have the potential to grow but they are in a zone of comfort as India is an excellent place for agriculture - specially the indus - ganges - btamhaputra river Valley.

这70%的人不关心正规教育。他们不消费任何工业制品。他们有增长的潜力,但他们生活怡然舒适,因为印度是一个农业的天堂—尤其是印度河-恒河- btamhaputra河谷一带。

LS Ganapati

In the current Globalized world, disruption/discontinuity of any nature impacting the ecosystem has adverse impact on the economic front. The rupee has been on the decline since early this year. The rupee is falling mainly due to high crude oil prices, a strong dollar overseas, and foreign capital outflows. These factors are making the dollar more attractive and the rupee riskier for investors.

在当今全球化的世界中,任何对生态系统的破坏/中断都会对经济产生不利影响。自今年年初以来,卢比一直在贬值。卢比下跌的主要原因是原油价格高企、海外美元走强以及外国资本外流。这些因素使得美元对投资者更具吸引力,而卢比的风险更高。

Prakash Bapat

Is Indian rupee backed by gold?

No!!

Today no cureency in the wirld is backed by gold.

Gold backing needs 50 % gold in value as compared to the notes printed by the government. While the currency in circulation is itself around ₹ 22 trn for india. While this itself will require some 8000 tons of gold to back it. India has hardly a thousand tonnes of gold. Or equivalent of 6% . As per wikipedia it is just 618 tonnes.

印度卢比是由黄金支撑的吗?

不!!

如今没有哪种货币是以黄金为后盾的。

与政府印制的纸币相比,若是以黄金为支撑,则需要50%的黄金价值。而对印度来说,流通中的货币约为22万亿卢比,这需要大约8000吨黄金来支持。但印度的黄金储备还不足1000吨,只相当于货币总额的6%。根据维基百科的数据,印度的黄金储备只有618吨。

The gold reserves are just very small and the currency remains floating. The currency value is no way connected to gold reserves today.

The currency value is rarely an indicator of the gold reserves. The most indebted country in the world is USA with a very large proportion of debt as external debt.

黄金储备非常少,而货币一直浮动。所以今天的货币价值与黄金储备没有必然联系。

货币价值并不反映黄金储备。世界上负债最多的国家是美国,其外债占很大比例。

But it's currency is so called world currency. It may loose that status in near future. It's gold reserves are not even 5 % of the external debt at current price of gold. Still so many countries hold that currency as a reserve as against gold.

These calculations are just for sake of understanding. There is much more to it than presented here.

但是美国的货币被称为世界货币,也许在不久的会来失去这种地位。美国黄金储备的价值甚至还不到当前外债的5%,但仍然有许多国家把美金作为储备,就像持有黄金一样。

这些计算只是为了便于你们理解。实际比我说的要复杂得多。

But Indians have a very large holdings of gold as compared to it's central bank.

Our mandirs are far richer than the RBI in terms of gold. While indians swallow as much as 800 tons of gold per year during various seasons. (Excluding the jwellary export)

Indians will be least affected if the global currency crashes or is changed to some gold backed currency.

但跟印度央行相比,印度民众持有了大量黄金。

就黄金而言,我们印度的寺庙比印度央行富裕得多。而印度人在不同季节每年要消费800吨黄金(不包括珠宝出口)。

如果全球货币崩溃或变成黄金支撑的货币,那么印度人受到的影响会是最小的。

Ashish Yadav

Is the rupee devaluation a help to the Indian economy?

卢比贬值对印度经济有利吗?

DEVALUATION simply means to make your currency lower than other currencies.

Effects of RUPEE devaluation :-

贬值的意思是你的货币价值比其他货币低。

卢比贬值的影响:

1-EXPORTS :-

As the currency is devalued, it’s exports will rise as the importers from other countries will have to pay less. It will boost our IT exports, pharmaceutical and handicraft exports.

For ex. :-

Suppose the price of pharmaceutical product is Rs 100.

Earlier 1 $ = 100 Rs.

Now 1$ = 110 Rs.

1-出口:

货币贬值可以促进出口,因为其他国家的进口商需要支付的费用少了,可以促进我们的信息技术、医药和工艺品出口。

例如:

假设药品的价格是100卢比。

以前1美元= 100卢比。

现在1美元= 110卢比。

So, if the trader want 10 pharmaceutical product earlier it used to coast 10$ but now it will cost 9.09$. So, saving for the trader. As, a result he will import more from us because it is costing him less.

But since INDIA is an import dominated country, who has it’s CAD always negative or we can say in deficit. Devaluation has more negative effects then positive.

因此,如果商人想要购买10种药品,以前需要10美元,现在只需9.09美元。所以,商人省钱了。结果,他会多从我们这里进口,因为这样花费更少。

但由于印度是一个以进口为主的国家,长期存在贸易逆差,或者说赤字。卢比贬值的负面影响大于正面影响。

2- IMPORTS :-

The import will rise as the value of currency falls, as a result increasing our CAD.

For ex. :-

Earlier 1$ = 100 Rs.

Now 1$ = 110 Rs.

Let’s take example of OIL. It’s the most imported product of our country.

So, Cost of 1 Barrel of OIL = $50 ( Rs. 5000) earlier

Now after Rs. devaluation the same will cost Rs. 5500.

Thus, it can be understood what impact the devaluation will have on our country, as we are importers.

2-进口:

货币贬值会促进进口,从而扩大我们的贸易逆差。

例如:

以前1美元= 100卢比。

现在1美元= 110卢比。

以石油为例,这是我国进口最多的产品。

早前一桶石油的价格是50美元(5000卢比)

现在卢比贬值后,一桶石油需要花费5500卢比。

因此,你们可以理解一下贬值对我们国家的影响,因为我们是进口商。

3- HIGHER INFLATION :-

A weak rupee will increase the burden of Oil Marketing Companies (OMCs) and this will surely be passed on to the consumers as the companies are allowed to do so following deregulation of petrol and partial deregulation of diesel. If the OMCs increase fuel prices, there will be a substantial increase in overall cost of transportation which will stoke up inflation. As, we know how important is OIL for our economy because a substantial increase in the price of oil can increase inflation to higher level.

3-更高的通胀:

卢比疲软会提高石油营销公司的成本,这肯定会转嫁给消费者。如果石油公司提高燃料价格,整体运输成本将大幅增加,这将进一步加剧通胀。我们知道石油对我们的经济有多重要,因为石油价格的大幅上涨可能会把通胀提高到更高的水平。

4- TRAVEL AND OVERSEAS EDUCATION :-

As price will be devalued so the cost of travelling to other countries will also increase and to study in foreign countries will also become more expensive.

We will take another example for that :-

Fees of STANFORD for M.B.A is $ 200,000 = Rs. 2,00,00,000 (Taken 1 $ = 100 Rs)

Now when the currency is devalued it wil cost Rs. 2,20,00,000.

A increase of Rs. 20 lakhs. You can imagine the effects.

4-旅游和海外教育:

由于卢比贬值,所以出国旅行的费用会增加,出国留学也会变得更加昂贵。

我们再举一个例子:

斯坦福大学MBA的学费是20万美元= 2000万卢比(取1美元= 100卢比)

现在,卢比贬值了,需要花费2200万卢比。

增加了200万卢比。你可以想象其影响。

All in all, a weaker rupee will reignite inflation. Thus, it can be said that devaluing currency in terms of INDIAN context does little good and more harm.

总而言之,卢比贬值将重新引发通胀。因此,针对印度而言,货币贬值有百害而无一利。

俄罗斯允许印度在国内生产IGLA-S便

俄罗斯允许印度在国内生产IGLA-S便 (VIP)所有产品都来自中国,只是在印

(VIP)所有产品都来自中国,只是在印 我是35岁的印度人,工作12年已经攒了

我是35岁的印度人,工作12年已经攒了 印媒:印度陆军将引进第一批阿帕奇武

印媒:印度陆军将引进第一批阿帕奇武 在印度,年薪400万卢比能过上什么样

在印度,年薪400万卢比能过上什么样 (VIP)印度营商环境令人堪忧,约3000

(VIP)印度营商环境令人堪忧,约3000 (VIP)俄罗斯坚持印度用人民币买石

(VIP)俄罗斯坚持印度用人民币买石 印媒:中印实控线对抗之际,印度军队在

印媒:中印实控线对抗之际,印度军队在